It has been awhile since I posted the beautiful (read: scary) charts of the ABX indices that were the start of all of this trouble:

These reflect the reality that has been driving the crisis in the credit markets.

This article does a great job walking through a summary of what has been going on in the underlying real estate mortgage markets. It is a great refresher or intro for anyone:

In a Credit Crisis, Large Mortgages Grow Costly

“When an investment banker set out to buy a $1.5 million home on Long Island last month, his mortgage broker quoted an interest rate of 8 percent. Three days later, when the buyer said he would take the loan, the mortgage banker had bad news: the new rate was 13 percent.”

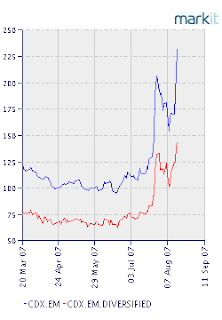

I also discovered these CDX indices for the first time tonight. They show how the woes that started with mortgages have now spread literally across the spectrum of the credit markets (and the equity markets of late):

Notice this Emerging Markets chart in particular:

The cost of protecting emerging market debt has almost doubled in the last week or two…one can only speculate about what is driving this particular factor, but I would imagine the “flight to quality” and “unwinding” of positions is to blame.

And the Asian markets continued their tumble overnight. Stay tuned.

What a good fund would have done:)

http://www.nytimes.com/2007/08/19/business/19credit.html?ex=1345262400&en=56c27baba8dc6ce2&ei=5124&partner=permalink&exprod=permalink

Asymmetric information is the game. But I feel in the case of subprime mortgages the CEOs of all the losing hedge funds had the blinders on.

Who would of thought that an America with an average household savings rate of effectively zero (and an continual CAD in the multiple billions) would not be able to pay back their 100% financed mortgages. I guess Mr. Melcher did. Just wait and see what happens when unemployment goes above 5%.

Cool article…as I talked to people about this problem over the last year, most people said: nothing will happen until there is an “event” to trigger it.

In other words, people seemed to acknowledge that there was some madness going on, but expected that it would keep going like a perpetual game of musical chairs would until the music was stopped by some “event”.

As it turns out, towers crumble by losing stability in their foundation little by little – even without an earthquake.