Although this blog post is somewhat sensational (even more than me):

CDS Phantom Menace

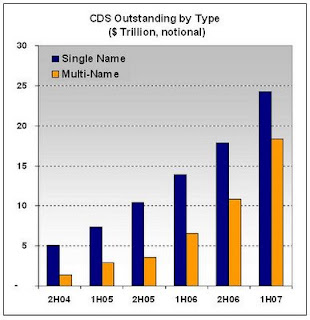

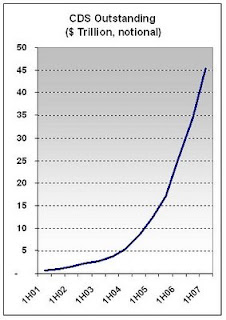

It did have some pretty sweet pictures of how big the CDS market is getting.

For those who don’t know, basically a Credit Default Swap (CDS) is like an insurance contract. In principle, it lets someone who wants to own a company’s bonds but doesn’t want to risk the company defaulting buy insurance from someone else, who is willing to pay the buyer of CDS protection the face value of the bond if a default happens. In theory, these contracts are used for hedging purposes and are great for isolating the “default” risk of a credit instrument from other risks like the risk of interest rate changes.

In practice, as you can see from the below graphs, the CDS market has become an area where people can either hedge entire portfolios of securities by buying a portfolio-based CDS. Or it allows people to speculate on the implosion of other companies by basically “shorting” the bonds (i.e. if you buy CDS protection and the company goes kaput, you get paid much in the same way that if you short a company’s stock, you get paid if they go belly-up).

What makes the above graphs scariest for me is what is referred to as counter-party credit risk. Basically this concept is why people like to put their money in FDIC-insured banks – if you enter a trade with the bank (i.e. I give you my money, you give it back when I need it with maybe a little interest), you don’t want to worry about them renegging on the deal.

Well in the wild world of CDS-trading, not all counterparties are as credit worthy as the FDIC. In fact, according to a structured derivatives expert I spoke with yesterday, and as discussed in this oldie-but goodie article: Buyers and sellers of CDSs not all sellers are created equally. In other words, there is a chance that the person writing your insurance won’t be there if the fan really gets hit.

Given the current conditions of the market, such a scenario does not seem that far afield. Let’s just hope I am just being paranoid.

But if a recent blog post regarding CDS exposure in insurance cos is any indication, there are major cracks in this market already beginning to form.