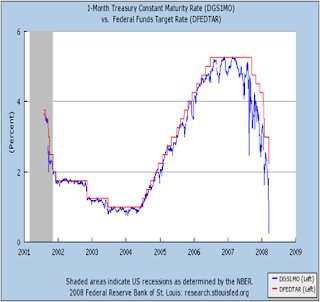

Courtesy of Paul Krugman’s commentary on Weird Interest Rates

Always, that is, until now. Treasury rates have plunged close to zero, even though Fed funds is still 2.25%. Since open-market operations take place in Treasuries, I take this to mean that the Fed may not actually be able to reduce short-term rates much from current levels — which means, in turn, that conventional monetary policy has been taken off the table.

There does not appear to be much more room for the Fed to move the needle with liquidity.