After Friday’s Bailout of Bear Stearns, less than 2 days later, it turns out that the Fed has encouraged a deal in which JP Morgan has agreed to completely bail out the company for $2/share.

J.P. Morgan Rescues Bear Stearns

Bear Stearns Cos. reached an agreement to sell itself to J.P. Morgan Chase & Co., as worries grew that failing to find a buyer for the beleaguered investment bank could cause the crisis of confidence gripping Wall Street to worsen.

The deal calls for J.P. Morgan to pay $2 a share in a stock-swap transaction, with J.P. Morgan Chase exchanging 0.05473 share of its common stock for each Bear Stearns share. Both companies’ boards have approved the transaction, which values Bear Stearns at just $236 million based on the number of shares outstanding as of Feb. 16. At Friday’s close, Bear Stearns’s stock-market value was about $3.54 billion

Falling into the “careful what you wish for camp” this quote jumps out:

“Bankruptcy experts said filing for bankruptcy protection wouldn’t have been an attractive option for Bear Stearns, partly due to recent changes in the federal Bankruptcy Code relating to financial instruments like derivatives and repurchasing trades. Unlike most parties in bankruptcy, lenders in such transactions aren’t stayed or prevented from acting to seize or control the assets involved in those deals.”

In other words, the same financial institutions who lobbied to change the bankruptcy code only a few years ago are likely now regretting such a decision as the ability to slow down collateral calls and liquidations with a bankruptcy filing is now a less viable option.

If this doesn’t wake up anyone who hasn’t been fearing a major catastrophe nothing will.

The Fed has been moving fast over the weekend broading the liquidity back stop announced last week.

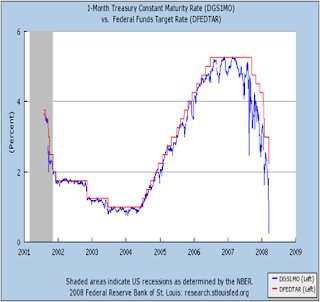

U.S. Fed Cuts Discount Rate, Says Dealers May Borrow

The Federal Reserve, in an emergency weekend decision, cut the rate on direct loans to commercial banks and opened up borrowing at the rate to primary dealers in government securities.

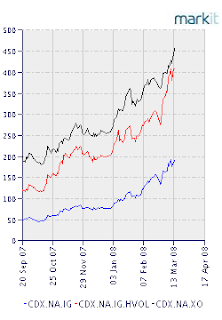

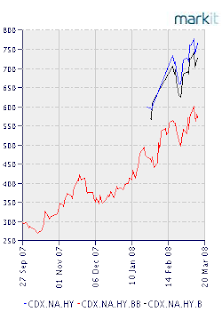

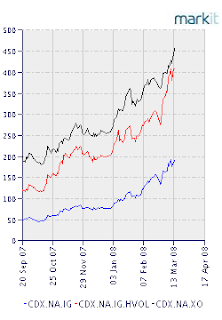

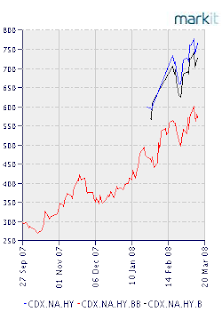

The credit markets have been anticipating this over the last month. These charts of the CDX indices express the fear that we are now seeing in equities:

There are many people prognosticating how the system could continue to unravel such as in this article in the NY Times published over the weekend: A Wall Street Domino Theory

This simple quote from the article underpins the biggest challenge facing the markets today: “In a trading firm, trust is everything”.

The underlying principle guiding indices like the “consumer confidence” index and the like reflect the fact that our economy and markets are predicated upon a confidence in a world of limited information.

The unraveling of AAA-rated entities and now a blue-chip financial institution call into doubt basic assumptions upon which people’s build their understanding of the economy and markets.

At this point I am starting to support the Fed in its efforts to prevent calamity primarily because I feel that the situation has gotten so dire that a lack of action could have brutal consequences…I prefer the “bull” part of my psyche and can’t wait for days when it can dominate the discussion again.